Fintech

Fractional Ownership: An Introduction

Fractional ownership, also called fractional investing, is the idea of taking one highly valuable asset or business and dividing this entity into many purchasable “shares”, which represent percentages of ownership.

For example, you may want to invest in real estate, but don’t have the money to purchase an entire house. Fractional ownership allows a company to split the value of a house into multiple shares, which a user can purchase. This means that an investor could get into the real estate market for as little as $25-$100, rather than the usual hundreds of thousands of dollars.

The fractional investment platforms that Scalio builds allow users to do just that. Whether it’s real estate, racehorses, or collectibles and memorabilia, we make it happen.

But how does fractional ownership work overall? In this blog, we’ll answer that question as well as give you some useful background information on how to understand the world of fractional ownership.

History of Fractional Ownership

The roots of fractional ownership can be tied to two major events. First, the financial crisis of 2008 left the US economy in need of financial stimulation. In response, the JOBS Act, signed by President Barack Obama on April 5, 2012, was meant to target small businesses specifically. Through several regulations and rules, the JOBS Act effectively:

- Lowered the requirements of small businesses when reporting to the SEC (Securities and Exchange Commission).

- Allowed for advertising of some security offerings

- Lowered restrictions on crowdfunding

Regulations A and CF specifically allowed for non-accredited investors to participate in certain offerings.

Accredited vs. Non-Accredited Investors

The purpose of the SEC is “to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation.” It was established after the financial chaos of the Great Depression in the United States. For that reason, one of its goals is to limit the number of uneducated investors in the stock market - for their own protection. Often, in order to invest, you must become an accredited investor.

Accredited investors are any individual:

- With a net worth of more than $1 million excluding the value of their primary residence or

- An income of more than $200,000 annually (or $300,000 combined income with a spouse) and expects the same income in the current year.

In the wake of the 2008 crisis, the weakened market was opened up to non-accredited investors in an attempt to revitalize the economy. With the introduction of the JOBS Act, non-accredited investors were given increased opportunity to invest, albeit in limited quantities for their own protection.

Fractionalizing Assets

Understanding regulations and different types of investors alone isn’t enough to grasp the mechanics of fractional ownership. The JOBS Act does not specifically allow for shares to be fractionalized, it regulates who can invest, how much, and which companies qualify for which exemptions.

A series LLC is often created to fractionalize an asset and make it available to investors. The series LLC allows the owner of the assets to silo off each asset individually. The individual assets can be divided into fractional shares and reach both accredited and non-accredited investors after registering the series LLC with the SEC under Reg A. This provides benefits to both the issuer and the investor. For the issuer, there is no need to create an individual LLC for each asset to then be fractionalized. For the investor, it is easier to diversify investments given the larger pool of assets available to invest in.

To summarize, once a company has an asset, creates an LLC, and files with the SEC under Regulation A, they are able to accept investors into any offering. All of the offering information is regulated and publicly available on the SEC website.

Fractional Ownership Example

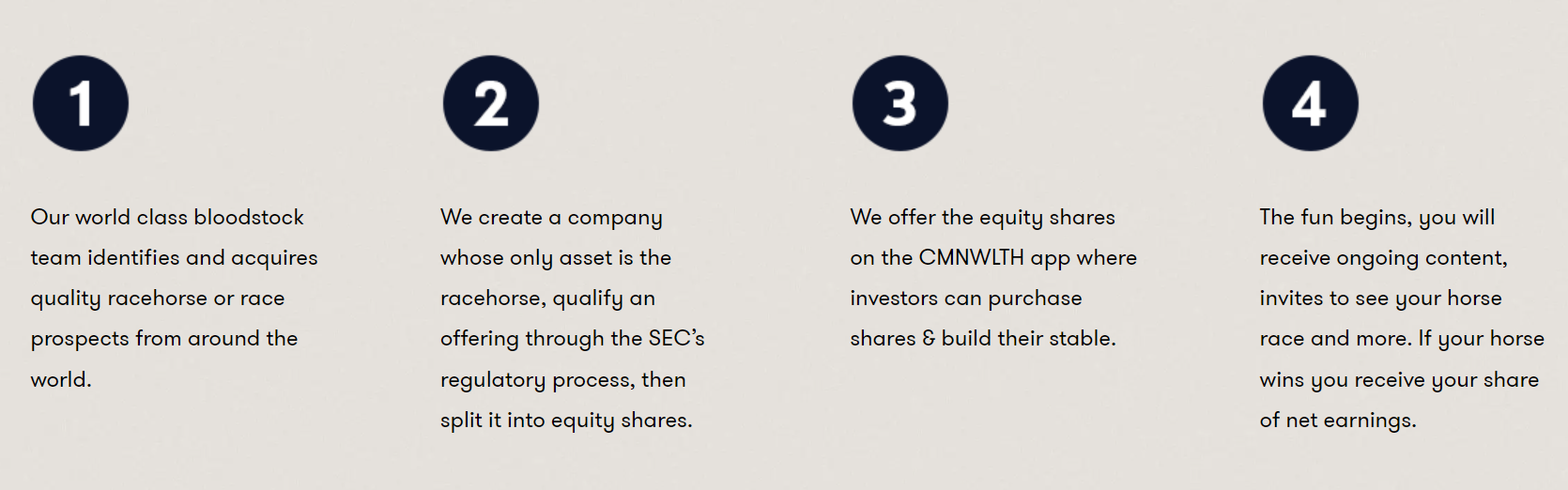

For an example, let’s look at Commonwealth, a fractional ownership platform for racehorses:

A racehorse serves as a “valuable asset.” A company (LLC) is created, with racehorses as assets that can be quickly made into offerings. The assets are split into equity shares and both accredited and non-accredited investors can invest.

Scalio led design and development for their fantastic iOS & Web applications, where users can go to purchase these shares.

Concluding Thoughts

Fractional ownership is a complex topic. To fully grasp it, you need to understand federal and state regulations, investor types, and how an asset is fractionalized. However, investor platforms can greatly simplify the process for investors and create massive value for companies looking to take part in fractional ownership. In upcoming blogs, we’ll be covering the technical aspects of such platforms as well as the details of federal and state regulations applying to these unique investment types.